Union Budget FY 2022-2023

The Budget goals for FY2022-23 aim to further India's aspirations in Amrit Kaal, as it moves towards its 100th year post independence.

- Focus on growth and all-inclusive welfare

- Promoting technology-enabled development, energy transition and climate action

- Virtuous cycle starting from private investment, crowded in by public capital investment

The Union Budget for FY 2022-23 this year aims to strengthen the infrastructure with its focus on four priorities of:

- PM GatiShakti

- Inclusive Development

- Productivity Enhancement & Investment, Sunrise opportunities, Energy Transition, and Climate Action

- Financing of investments

The Union Budget website lists the Highlights of the FY 2022-23 Budget. The Press Information Bureau (PIB) website provides a summary of the Budget. The Productivity Linked Incentive in 14 sectors for achieving the vision of AtmaNirbhar Bharat has received excellent response, with potential to create 60 lakh new jobs, and an additional production of Rs 30 lakh crore during next 5 years.

Key Features

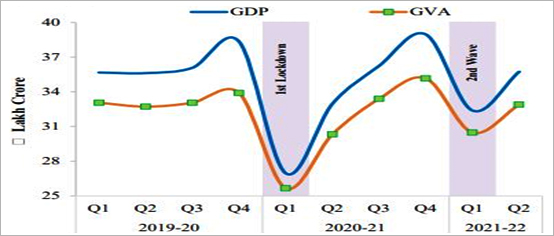

India's GDP has witnessed robust recovery twice with the past two waves of the pandemic, a testimony to the nation's economic resilience.

- Providing Greater Fiscal Space to States

- Enhanced outlay for 'Scheme for Financial Assistance to States for Capital Investment' from Rs.10,000 crore in Budget Estimates to Rs.15,000 crore in Revised Estimates for current year

- Allocation of Rs.1 lakh crore in 2022-23 to assist the states in catalysing overall investments in the economy: fifty-year interest free loans, over and above normal borrowings

- In 2022-23, States will be allowed a fiscal deficit of 4% of GSDP, of which 0.5% will be tied to power sector reforms

- Rs.2.37 lakh crore direct payment to 1.63 crore farmers for procurement of wheat and paddy

- Chemical free Natural farming to be promoted throughout the county. Initial focus is on farmer's lands in 5 Km wide corridors along river Ganga

- NABARD to facilitate fund with blended capital to finance startups for agriculture & rural enterprise

- 'Kisan Drones' for crop assessment, digitization of land records, spraying of insecticides and nutrients

- MSMEs & Industry

- Udyam, e-shram, NCS and ASEEM portals to be interlinked

- 130 lakh MSMEs provided additional credit under Emergency Credit Linked Guarantee Scheme (ECLGS)

- ECLGS to be extended up to March 2023

- Guarantee cover under ECLGS to be expanded by Rs.50000 Crore to total cover of Rs.5 Lakh Crore

- Rs.2 lakh Crore additional credit for Micro and Small Enterprises to be facilitated under the Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE)

- Raising and Accelerating MSME performance (RAMP) programme with outlay of Rs.6000 Crore to be rolled out

- Education

- One class-One TV channel' programme of PM eVIDYA to be expanded to 200 TV channels

- Virtual labs and skilling e-labs to be set up to promote critical thinking skills and simulated learning environment

- High-quality e-content will be developed for delivery through Digital Teachers

- Digital University for world-class quality universal education with personalised learning experience to be established

- Public Capital Investment

- Public investment to continue to pump-prime private investment and demand in 2022-23

- Outlay for capital expenditure stepped up sharply by 35.4% to Rs.7.50 lakh crore in 2022-23 from Rs.5.54 lakh crore in the current year

- Outlay in 2022-23 to be 2.9% of GDP

- 'Effective Capital Expenditure' of Central Government estimated at Rs.10.68 lakh crore in 2022-23, which is about 4.1% of GDP

- Public investment to continue to pump-prime private investment and demand in 2022-23

- Saksham Anganwadi

- Integrated benefits to women and children through Mission Shakti, Mission Vatsalya, Saksham Anganwadi and Poshan 2.0

- Two lakh anganwadis to be upgraded to Saksham Anganwadis

- Health

- An open platform for National Digital Health Ecosystem to be rolled out

- National Tele Mental Health Programme’ for quality mental health counselling and care services to be launched

- A network of 23 tele-mental health centres of excellence will be set up, with NIMHANS being the nodal centre and International Institute of Information Technology-Bangalore (IIITB) providing technology support

- Energy Transition & Climate Action

- Additional allocation of Rs.19,500 crore for Production Linked Incentive for manufacture of high efficiency solar modules to meet the goal of 280 GW of installed solar power by 2030

- Five to seven per cent biomass pellets to be co-fired in thermal power plants:

- CO2 savings of 38 MMT annually

- Extra income to farmers and job opportunities to locals

- Help avoid stubble burning in agriculture fields

- Four pilot projects to be set up for coal gasification and conversion of coal into chemicals for the industry

- Financial support to farmers belonging to Scheduled Castes and Scheduled Tribes, who want to take up agro-forestry

- Additional allocation of Rs.19,500 crore for Production Linked Incentive for manufacture of high efficiency solar modules to meet the goal of 280 GW of installed solar power by 2030

- Sunrise Opportunities

- Government contribution to be provided for R&D in Sunrise Opportunities like Artificial Intelligence, Geospatial Systems and Drones, Semiconductor and its eco-system, Space Economy, Genomics and Pharmaceuticals, Green Energy, and Clean Mobility Systems

- Banking

- 100 per cent of 1.5 lakh post offices to come on the core banking system.

- Scheduled Commercial Banks to set up 75 Digital Banking Units (DBUs) in 75 districts

< li>Agriculture and Allied Sectors

Key Features

Key documents such as those listed below are tabled in the parliament during the Budget presentation process.

- Annual Finance Statement (AFS)

- Demand for Grants (DG)

- Finance Bill

Explanatory statements such as those listed below are also presented for ready references.

- Expenditure Budget

- Receipt Budget

- Expenditure Profile

- Budget at a Glance

- Memorandum Explaining the provisions in the Finance Bill

- Output Outcome Monitoring Framework